Update on Tilapia in the United States

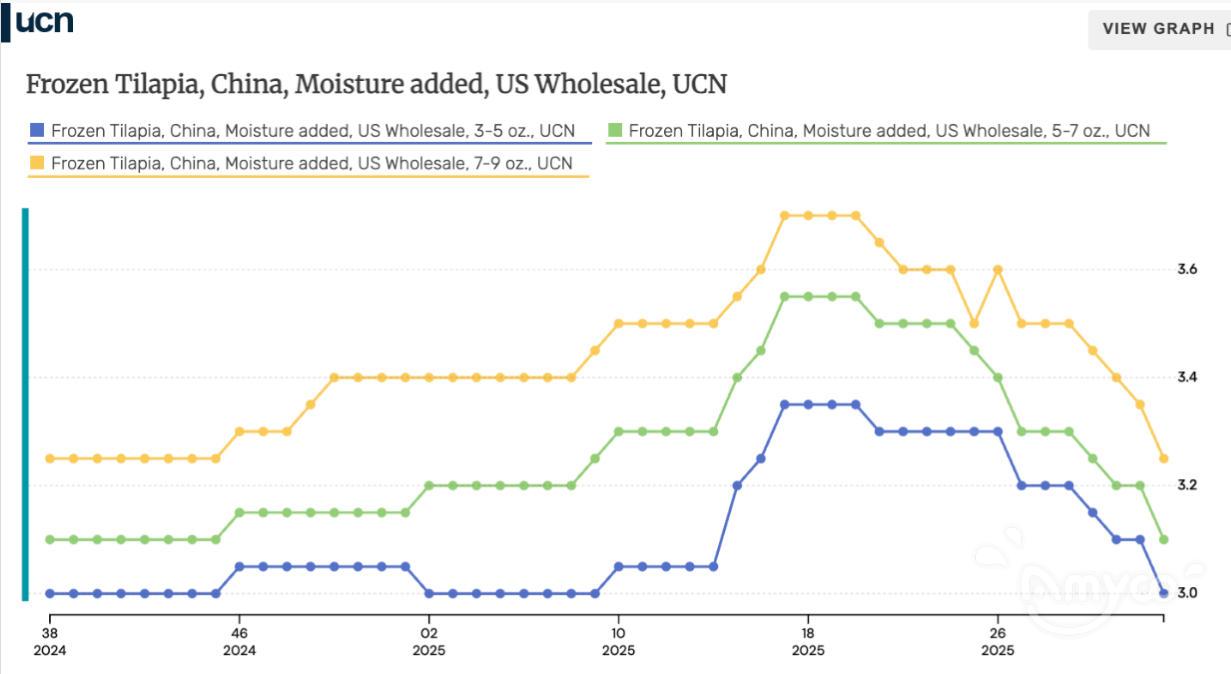

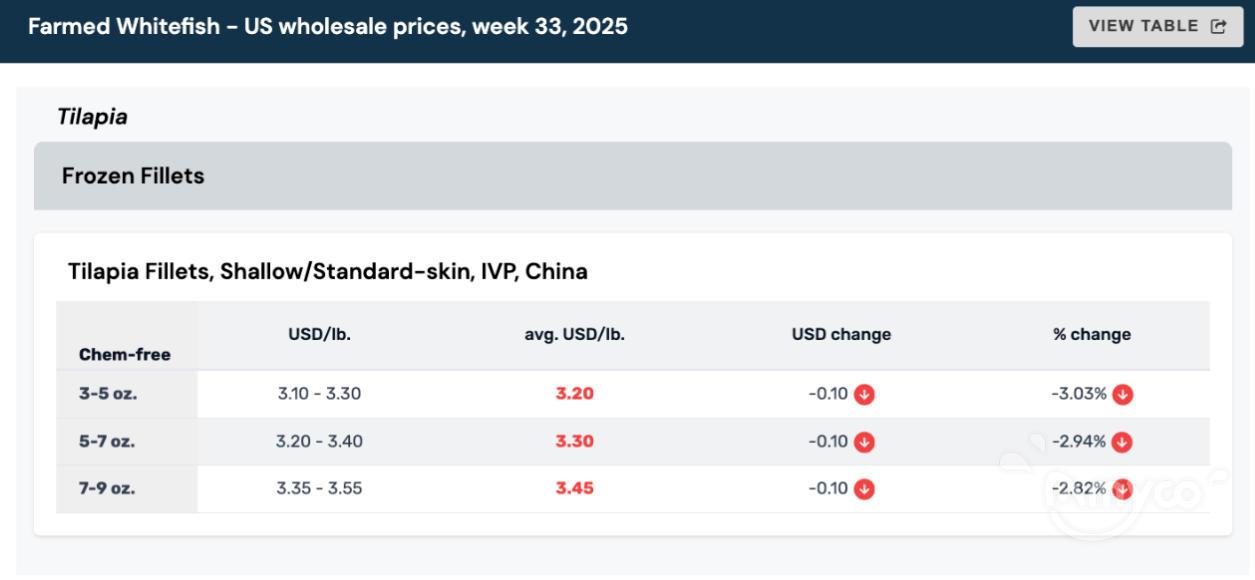

Over the past month, the wholesale market for frozen tilapia in the United States has experienced a continuous decline. In Week 33 (August 11-17), the average price fell by $0.10/lb, with declines ranging from 2.8% to 3.2% across all sizes.

Since July, the number of tilapia orders between China and the United States has plummeted. Although American buyers have been stocking up in advance, import tariffs as high as 55% have been implemented since May 12th, exceeding the total tariff rate for all other imported seafood products. After nearly two months of growth, US demand has gradually weakened, and the market is currently stuck in a stalemate of high inventory, high costs, and low circulation.

In Week 33, the US market remained generally oversupplied, with importers facing significant inventory issues. Neither the retail nor the restaurant sectors showed any continued growth, leading buyers to be cautious in placing orders.

Chinese exporters offered DDP terms and other price-cutting promotions to the US market in an attempt to mitigate risk for US buyers. However, these efforts failed to generate new orders.

The summer months, peak tilapia harvest season, coupled with a lack of US demand, pushed raw material prices to historic lows. For example, 500-800g of raw material sold for CNY 7.3/kg in Guangdong and CNY 7.6/kg in Hainan.

On August 11, the interim China-US trade agreement was extended for 90 days, maintaining the 55% tariff on tilapia. This rate has done little to restore market confidence, as deeper issues on the demand side are the real problem.

Due to overstocked inventory and sluggish sales, buyers are reluctant to sign long-term contracts. Some buyers have already begun inquiring about prices, suggesting at least initial purchasing interest. Any near-term price rebound will likely be gradual.

Reference : UCN